child tax portal says not eligible

This does not. If your qualifying child was alive at any time during 2021 and lived with you for more than half the time in 2021 that the child was alive then your child is a qualifying child for purposes of the 2021 Child Tax Credit.

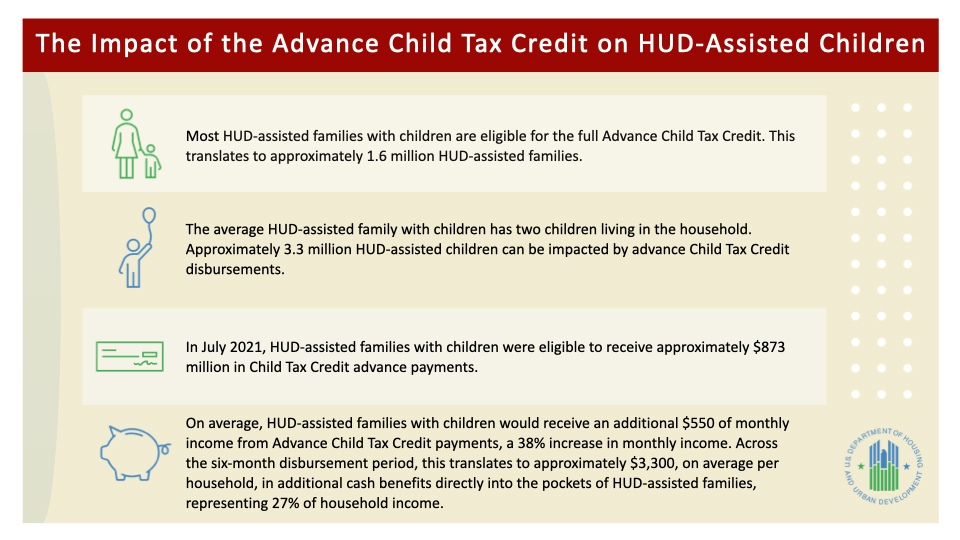

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Your 2021 Baby Makes You Eligible for the Child Tax Credit Find.

. 150000 if married and filing a joint return or if filing as a qualifying widow or. That they havent updated it. On the portal it says that shes not eligible I called the IRS they said to check every day.

You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Check your processed payment tab. Youve entered something wrong.

Maybe 6 in your case. You can no longer view or manage your advance Child Tax. E-File Directly to the IRS.

For example if you have not received. Your 2021 Baby Makes You Eligible for the Child Tax Credit Find. Ad Home of the Free Federal Tax Return.

But my fiance didnt we both filed our 2020 taxes each clamied a kid under 5 years old filed separately. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. How the Child Tax Credit Will Affect Your 2021 Taxes Additionally you and your child must be US.

There are 6 possible reasons. If you are a taxpayer then it could be because there is a hold or problem with your return. The Child Tax Credit Update Portal is no longer available.

Checked again this morning and it says not eligible. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. As a result you were eligible to receive advance Child Tax Credit payments for your qualifying child.

If you sign in to the child tax credit portal and you do not see any notification displayed on the landing page that you are eligible for the credit there can be a couple of things wrong. I got my child tax credit. There are several stipulations as to who can receive the child tax credit and who cannot beyond just the income threshold.

If your modified adjusted gross income is too high then you wont get a child tax credit. In the personal Info section for the dependent you must select answers that indicate that heshe is your dependent child. You arent getting the Child Tax credit CTC.

First make sure you do not qualify as a non-filer. I only made 12000 last year. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

One South Carolina mother reached out to the Washington Post upset that she did get the advance child tax credit payments for her two. This does not. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify.

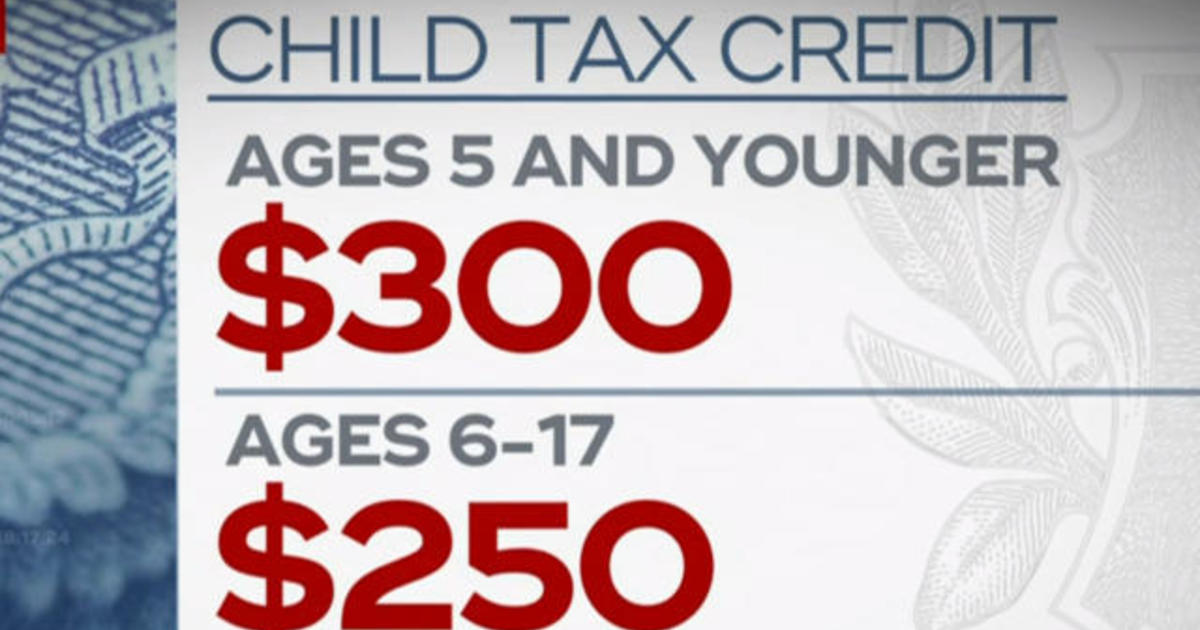

How the Child Tax Credit Will Affect Your 2021 Taxes Additionally you and your child must be US. The IRS will pay half the total credit amount in advance monthly payments.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit 2022 Update 750 Direct Payments Available This Summer Find Out How To Get Your Hands On Cash The Us Sun

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

The Child Tax Credit Toolkit The White House

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

2021 Child Tax Credit Advanced Payment Option Tas

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Child Tax Credit Toolkit The White House

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

How The New Expanded Federal Child Tax Credit Will Work

Child Tax Credit 2021 8 Things You Need To Know District Capital